Top 1200 Tax Returns Quotes & Sayings - Page 6

Explore popular Tax Returns quotes.

Last updated on December 20, 2024.

Taxing Women is a must-have primer for any woman who wants to understand how our current tax system affects her family's economic condition. In plain English, McCaffery explains how the tax code stacks the deck against women and why it's in women's economic interest to lead the next great tax rebellion.

In 2013 Citigroup had profits of $6.4 billion in the United States. They paid no federal income tax and, in fact, received a rebate from the IRS of $260 million. That same year J.P. Morgan had $17.2 billion in profits in the U.S. They also paid no federal income tax. Do you think it's time for tax reform?

Well the thinking is we have the highest tax rate in the world. In the entire world, we have the highest tax rate. There's gridlock in Washington because there's no leadership. So what I'm doing is a large tax cut especially for the middle class and they're gonna- we're going to have a dynamic country. We're going to have dynamic economics. And it's going to be something really special. And people are going back to work.

When two working people decide to marry, their federal income tax is usually increased. As soon as one spouse earns at least 20 percent of a married couple's total income, the couple pays a 'marriage tax.' ... The United States is the only major industrialized nation in the free world in which the tax cost of the second [married] earner's entry into the work force is higher than that of the first. On one hand, our government's social policy is to help working women earn equal salaries to those of men, but on the other we have a tax structure that penalizes them when they do so.

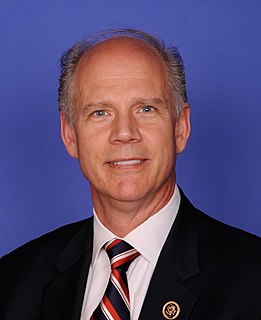

The reason we've been growing at 1.8 percent for the last eight, ten years, which is way below the historical average, is in large part because of our tax code. It is important to us to get the biggest, broadest tax reduction, tax cuts, tax reform that we can possibly get because it's the only way we get back to 3 percent growth. That's what's driving all of this, how do you get the American economy back on that historical growth rate of 3 percent and out of these doldrums of 1.8, 1.9 that we had of the previous Barack Obama administration?

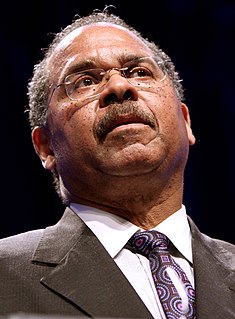

We need real tax reform which makes the rich and profitable corporations begin to pay their fair share of taxes. We need a tax system which is fair and progressive. Children should not go hungry in this country while profitable corporations and the wealthy avoid their tax responsibilities by stashing their money in the Cayman Islands.

Tax rates aren't everything with regard to incentives to work. I would probably work at a 100% tax rate next to a nude modeling studio. I'm joking, but you know what I'm saying. There's a lot more to it than just tax rates. It's economics that I do; I don't do nude modeling studio economics. People do respond to taxes.

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

Well, certainly the Democrats have been arguing to raise the capital gains tax on all Americans. Obama says he wants to do that. That would slow down economic growth. It's not necessarily helpful to the economy. Every time we've cut the capital gains tax, the economy has grown. Whenever we raise the capital gains tax, it's been damaged.

It was not until the Abraham Lincoln administration that an income tax was imposed on Americans. Its stated purpose was to finance the war, but it took until 1872 for it to be repealed. During the Grover Cleveland administration, Congress enacted the Income Tax Act of 1894. The U.S. Supreme Court ruled it unconstitutional in 1895. It took the Sixteenth Amendment (1913) to make permanent what the Framers feared -- today's income tax.