Top 1200 Tax Quotes & Sayings - Page 11

Explore popular Tax quotes.

Last updated on December 12, 2024.

We also need the provisions in the tax bill that will permit working mothers to increase the deduction from income tax liability for costs incurred in providing care for their children while the mothers are working. In October the Commission on the Status of Women will report to me. This problem should have a high priority, and I think that whatever we leave undone this year we must move on this in January.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

A carbon tax by itself would make driving more expensive, that's very true. But in exchange for that, there are going to be more jobs, more output, more employment, and more products available. So really, as long as you're going to collect the revenues you're going to collect, you're going to have to trade off one tax for the other.

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.

If we can’t puncture some of the mythology around austerity, politics or tax cuts or the mythology that’s been built up around the Reagan revolution, where somehow people genuinely think that he slashed government and slashed the deficit and that the recovery was because of all these massive tax cuts, as opposed to a shift in interest-rate policy - if we can’t describe that effectively, then we’re doomed to keep on making more and more mistakes.

We also need to encourage Americans to become more fiscally responsible themselves. We can do this by redesigning our tax system into an expenditure tax with a single flat rate. ... We have to substantially reduce the size and scope of the federal government, fundamentally increase the role of the states in choosing their own practices, and bring decision-making closer to the people, not to unelected administrators. These steps are crucial to getting our nation on a path of fiscal, political and constitutional responsibility.

Churches are tax exempt because they are supposed to provide a public good. To prove that good to the IRS, churches arent supposed to hoard their money. They are supposed to spend it on goods and services for the faithful. Under this pretense, the church has made massive investments in tax free real estate all over the world. And when it comes to labor costs, they are almost free.

I think what grows the economy is when you get that tax credit that we put in place for your kids going to college. I think that grows the economy. I think what grows the economy is when we make sure small businesses are getting a tax credit for hiring veterans who fought for our country. That grows our economy.

Suppose that throughout your childhood you were good with numbers. Other kids used to copy your homework. You figured store discounts faster than your parents. People came to you for help with such things. So you took accounting and eventually became a tax auditor for the IRS. What an embarrassing job, right? You feel you should be writing poetry or doing aviation mechanics or whatever. But then you realize that tax collecting can be a calling too.

I am humbly following in your footsteps and having a row with the Government over the iniquity of the Marriage Tax in the form of supertax ... our incomes being added together we are liable for supertax which we are refusing to pay on the grounds of morality as I consider in a Christian country it is an immoral and outrageous act to tax me because I am living in Holy matrimony instead of as my husband's mistress.

Even if Bush could be forgiven for taking America, and much of the rest of the world, to war on false pretenses, and for misrepresenting the cost of the venture, there is no excuse for how he chose to finance it. His was the first war in history paid for entirely on credit. As America went into battle, with deficits already soaring from his 2001 tax cut, Bush decided to plunge ahead with yet another round of tax "relief" for the wealthy.

Now all of the ideas that I'm talking about, they are not radical ideas. Making public colleges and universities tuition free, that exists in countries all over the world, used to exist in the United States. Rebuilding our crumbling infrastructure, and creating 13 million jobs by doing away with tax loopholes that large corporations now enjoy by putting their money into the Cayman Islands and other tax havens. That is not a radical idea.

From 2008 to 2016 all the growth in the American economy, all the growth in national income, was earned just by the wealthiest 5% of the population. So they got all the growth. 95% of the population didn't grow. If you can get a flat tax or other lower tax, as Trump is suggesting, then this richest 5% will be able to keep even more money. That means that the 95% will be even poorer than they were before, relative to the very top.

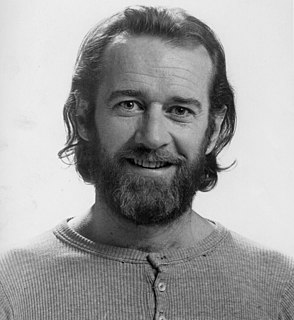

I don't know how you feel, but I'm pretty sick of church people. You know what they ought to do with churches? Tax them. If holy people are so interested in politics, government, and public policy, let them pay the price of admission like everybody else. The Catholic Church alone could wipe out the national debt if all you did was tax their real estate.

When I left law school, I wanted to go into the government, into the tax policy area. I got the job that I wanted in the International Tax Council's office in Treasury. I arrived determined to change the world. But I discovered very quickly that the world couldn't care less. And I couldn't stomach the lying and stealing that I witnessed. I realized that the only difference between my mother's family and the senators and administrators that I was working with was that the latter wore suits and ties.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.

Budget deficits are not caused by wild-eyed spenders, but by slow economic growth and periodic recessions. And any new recession would break all deficit records. In short, it is a paradoxical truth that tax rates are too high today and tax revenues are too low, and the soundest way to raise the revenues in the long run is to cut the rates now.

He should release the tax returns tomorrow. It's crazy. You've got to release six, eight, ten years back tax returns. Take the hit for a day or two. He has to give a big speech in defense of capitalism, and that will elevate, I think, this race above this tactical back and forth, which I do think he's on the margin of losing.

Taxes are paid in the sweat of every man who labors. If those taxes are excessive, they are reflected in idle factories, in tax-sold farms, and in hordes of hungry people, tramping the streets and seeking jobs in vain. Our workers may never see a tax bill, but they pay. They pay in deductions from wages, in increased cost of what they buy, or - as now - in broad unemployment throughout the land.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

After 25 quarters of so-called recovery under Obama, it has increased a total of only 14.3 percent. Compare this to earlier periods. After the JFK tax cuts of the early 1960s, the economy grew in total by roughly 40 percent. After the Reagan tax cuts of the 1980s, the economy grew by a total of 34 percent.

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

And above all, above all, honest work must be rewarded by a fair and just tax system. The tax system today does not reward hard work: it penalizes it. Inherited or invested wealth frequently multiplies itself while paying no taxes at all. But wages on the assembly line or in farming the land, these hard-earned dollars are taxed to the very last penny.

I kid the Republicans, with love. I feel bad for them. They got nobody for next time. Who are they gonna run? Sarah Palin, reading off her hand. Did you see that? You saw this? She wrote "tax cuts" on her hand. A Republican so stupid she has to be reminded of the one thing - Tax cuts! This is like if you saw the coyote's paw and it said "Road Runner".

If you tell people, 'that old banger of yours, we're going to tax the hell out of it,' they'll rightly tell you to get lost. But if you tell people that when they next buy a car, the tax will be adjusted so that the cleanest ones will cost less and the polluting ones will cost more, most people would say 'fair enough.'

Remember back in the nineties, a bunch of Democrats decided to tax luxury items, including yachts? They figured it was not fair that some people could afford yachts, and so since they could, they said, "We're gonna tax the hell out of yachts at the point of sale, 'cause it's not fair. We need to collect revenue from all this!" What happened was that the people who actually build the yachts lost their jobs because people stopped buying them.

To some, a cap-and-trade system might sound like a neat approach where the market sorts everything out. But in fact, in some ways it is worse than a tax. With a tax, the costs are obvious. With a cap-and-trade system, the costs are hidden and shifted around. For that reason, many politicians tend to like it. But that is dangerous.

I have no political ax to grind; I just find it absurd that huge billion-dollar corporations can take over elections. I just find it insane that, for instance, we give tax breaks to people like myself making millions of dollars, while there're no tax breaks for working people. That, to me, is not a political issue, that's a life issue.

When a company wants to move to Mexico or another company - or another country and they want to build a nice, beautiful factory and they want to sell their product through our border, no tax, and the people that all got fired, so we end up with unemployment and debt, and they end up with jobs and factories and all of the other things, not going to happen that way. And the way you stop it is by imposing a tax.

We really believe that we can bring about changes in the tax code that will make America more attractive for investment and job creation and business. But the president has also made it very clear that he wants to put - he wants to put new elements in the tax code that are going to have companies pay a price if they decide to take jobs out of the country and then sell their goods back into the United States.

I don't like the income tax. Every time we talk about these taxes we get around to the idea of 'from each according to his capacity and to each according to his needs'. That's socialism. It's written into the Communist Manifesto. Maybe we ought to see that every person who gets a tax return receives a copy of the Communist Manifesto with it so he can see what's happening to him.

You compare the nation to a parched piece of land and the tax to a life-giving rain. So be it. But you should also ask yourself where this rain comes from, and whether it is not precisely the tax that draws the moisture from the soil and dries it up. You should also ask yourself further whether the soil receives more of this precious water from the rain than it loses by the evaporation?

Democrats in Washington predicted that tax cuts would not create jobs, would not increase wages, and would cause the federal deficit to explode. Well, the facts are in. The tax cuts have led to a strong economy. Real wages were on the rise, and deficit has been cut in half three years ahead of schedule.

As to the Income Tax, my opinion is that the needful revenue would be fairly and most fairly raised if paid by property, and by individuals in proportion to their property. A Property Tax should be an assessment upon all land and buildings, and canals and railroads, but not on property such as machinery, stock in trade, etc. The aristocracy have squeezed all they can out of the mass of the consumers, and now they lay their daring hands on those not wholly impoverished.

You take the huge income that comes with a big gas tax, and you use it to pay off regressive taxes like the FICA [Federal Insurance Contributions Act] tax. You can help the poor in other ways besides giving them cheap gas. You want to send the message that people want to be as efficient as possible using gasoline until we can transition away from that need entirely.

Economists are almost unanimous in conceding that the land tax has no adverse side effects. ...Landowners ought to look at both sides of the coin. Applying a tax to land values also means removing other taxes. This would so improve the efficiency of a city that land values would go up more than the increase in taxes on land.

In those countries where income taxes are lower than in the United States, the ability to defer the payment of U.S. tax by retaining income in the subsidiary companies provides a tax advantage for companies operating through overseas subsidiaries that is not available to companies operating solely in the United States. Many American investors properly made use of this deferral in the conduct of their foreign investment.

Our ideal society finds it essential to put a rent on land as a way of maximizing the total consumption available to the society. ...Pure land rent is in the nature of a 'surplus' which can be taxed heavily without distorting production incentives or efficiency. A land value tax can be called 'the useful tax on measured land surplus'.

It was an easy thing to tax for a young country. And then gradually we moved to property taxes, manufacturing taxes, and the income tax was the answer to a populist demand: Let's go after the rich guys. We got into World War I, and they raised the rates and started taxing the rich. Then we got into World War II, and that's when they taxed everybody, because they just needed more revenue.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

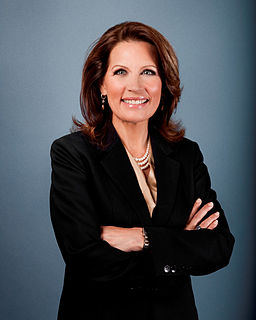

I'm not only a lawyer, I have a post doctorate degree in federal tax law from William and Mary. I work in serious scholarship and work in the United States federal tax court. My husband and I raised five kids. We've raised 23 foster children. We've applied ourselves to education reform. We started a charter school for at-risk kids.

The Founding Fathers realized that "the power to tax is the power to destroy," which is why they did not give the Federal government the power to impose an income tax. Needless to say, the Founders would be horrified to know that Americans today give more than a third of their income to the Federal government.

There are several states that move from Karl Marx-like policies to Adam Smith-like policies and back again in a weekend. So for the states with huge volatility in their income tax policies over time, the differences in growth rates in those periods are really amazingly consistent with tax rates really mattering.

Currency speculation-over a trillion dollars a day-is a tax-free activity. The notion of a tax on "day trades" or other speculative swaps was revived in recent years, but has been studiously ignored by all our purveyors of conventional economic wisdom. That is because we have been persuaded, against logic, and moral sense, that the institution that most needs our support these days is not society, nor the human community, but the global corporation.