Top 1200 Tax Quotes & Sayings - Page 2

Explore popular Tax quotes.

Last updated on December 4, 2024.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

[In Mexico] they have a VAT tax. We're on a different system. When we sell into Mexico, there's a tax. When they sell in - automatic, 16 percent, approximately. When they sell into us, there's no tax. It's a defective agreement. It's been defective for a long time, many years, but the politicians haven't done anything about it.

Why do we fully tax some kinds of income from capital, like interest and dividends; partially tax other kinds like capital gains; defer tax on other kinds, like IRAs; and impose no tax at all on still other types of capital income, like interest on municipal bonds? This simply is not rational. These distinctions don't have any inherent logic.

I think that taxes would be fair if we first get rid of the tax code. This is the ultimate solution, not to just say we're going to trim around the edges, not to say that we will try to simplify a little of this and a little of that. The problem is, replace the tax code, so we can establish tax fairness for everybody.

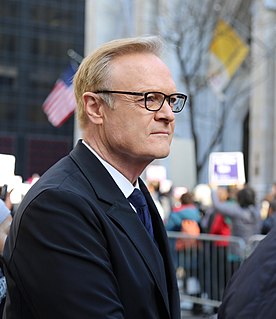

Any Democrat who squirms on the tax-cut issue in the primaries has no chance ' zero ' to win the nomination. Each will have to take the “pledge” to oppose the Bush tax cuts. Thus, Bush will have succeeded in creating a situation where anyone who can win the nomination can't win the election. Democrats are not about to nominate anyone who backs the tax cut, and Americans are not going to elect anyone who favors a tax increase.

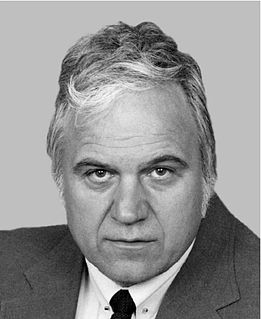

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

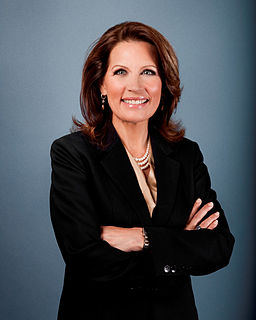

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

By stopping the flow of illegal immigration, we will save countless tax dollars, and that's so important because the tax - the dollars that we're losing are beyond anything that you can imagine. And the tax dollars that can be used to rebuild struggling American communities - including our inner cities.

One measure for promoting both stability and fairness across financial market segments is a small sales tax on all financial transactions - what has come to be known as a Robin Hood Tax. This tax would raise the costs of short-term speculative trading and therefore discourage speculation. At the same time, the tax will not discourage "patient" investors who intend to hold their assets for longer time periods, since, unlike the speculators, they will be trading infrequently.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

If I get married I get a tax break, if I have a kid I get a tax break, if I get a mortgage I get a tax break. I don't have any kids and I drive a hybrid, I think I should get a tax break. I'm trying to pay off my apartment so I have something tangible. I actually figured out if I paid off my place my reward would be that I would pay an extra four grand a year in taxes.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

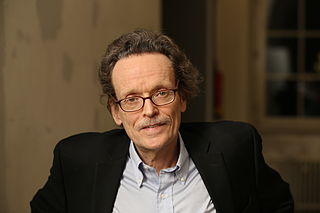

It turns out a VAT - a value-added tax - is a very easy tax to collect and a very hard tax to evade. It's a really good idea. It was invented about 60 years ago in France, of course. Because they're so good at taxing. They had a business tax that was easy to evade, and the head of the French IRS invented this value-added tax, which is very hard to evade.

We've been prepared to make the arguments for lowering corporation tax, which is all about encouraging risk takers, encouraging entrepreneurs, and I observe that for the vast majority of the Labour government we had a top rate of 40 per cent income tax. It's now higher, and I think we should look to get to a simpler, lower tax system.

Start by scrapping the tax code. Don't fiddle with it. Junk it. Throw it out. Bury it. Replace it with a pro-growth, pro-family tax cut that lowers tax rates to 17% across the board and expands exemptions for individuals and children so that a family of four would pay no taxes on the first $36,000 of income.