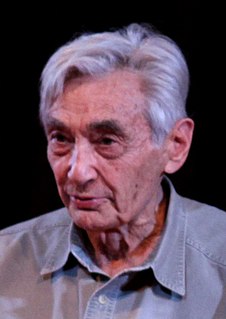

A Quote by Bruce Bartlett

Up until 1986, the top marginal rate, the top statutory rate was 50 percent. Now it's 35 percent. And all the pressure is on to lower that even further. And this just doesn't make a great deal of sense. When people say, 'Oh, we can't raise taxes on the rich. They'll go on strike, they'll move to another country.' But within recent memory, it hasn't been that long ago that we had rates that were substantially higher. And these people did just fine. I just think that there's a disconnect between the facts of what taxes do and the sort of mythology of what they do.

Quote Topics

Related Quotes

First, the oil and gas business pays its fair share of taxes. Despite the current debate on energy taxes, few businesses pay more in taxes than oil and gas companies. The worldwide effective tax rate for our industry in 2010 was 40 percent. That's higher than the U.S. statutory rate of 35 percent and the rate for manufacturers of 26.5 percent.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

President Lyndon Johnson's administration was known for his War on Poverty. President Obama's will become notable for his War on Prosperity. We're speaking, of course, of Obama's plans to hike income taxes on the most wealthy 2 or 3 percent of the nation. He's not just raising the top rate to 39.6 percent; he's also disallowing about one-third of top earner's deductions, whether for state and local taxes, charitable contributions or mortgage interest. This is an effective hike in their taxes by an average of about 20 percent.

The black unemployment rate has to be twice that of the white rate in the US. If the national unemployment rate were 6.8 percent, everyone would be freaking out. We ought to not take too much solace in the 6.8 percent, but ask ourselves what can we do to bring that down to white rates, which are below 4 percent now. Some of that has to do with education, but that's just part of the story. You find that those unemployment differentials persist across every education level. I think it means pushing back on discrimination and helping people who can't find work get into the job market.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

Barack Obama is talking about cutting taxes. On net, he is a tax cutter. But the difference between Obama and John McCain is that Obama is raising some taxes on families, for example, with incomes over $250,000. Now, that amounts to about 2 percent, the richest 2 percent of American households. And even with those tax changes, even with all of the tax changes Obama's talking about, taxes will be lower under Obama than they were under the Clinton years.

We're bringing the corporate rate down to 20 percent from 35 percent. That's a massive - this will be the biggest tax cut in history. In the history of our country. And that's great. And we need it. Because right now, our country's about the highest taxed or certainly one of the highest taxed in the world. And we can't have that. So we're going to have a country that's toward the lower end.