A Quote by Chanda Kochhar

The real underlying value comes if you can put a company back into a running state and it becomes a successful viable entity if it continues to repay loans.

Related Quotes

The more successful the unit, the more difficult it is to make sure that the large company doesn't put the same expectations on it as it does for the rest of the company. When it's a new venture, whether it's outside or inside the business, it's a child. And you don't put a 40-pound pack on a 6-year-old's back when you take her hiking.

I have my own theory about why decline happens at companies like IBM or Microsoft. The company does a great job, innovates and becomes a monopoly or close to it in some field, and then the quality of the product becomes less important. The company starts valuing the great salesmen, because they’re the ones who can move the needle on revenues, not the product engineers and designers. So the salespeople end up running the company.

Most Americans instinctively recoil from the claim that there is an antireligious bias running through the underlying assumptions with which their society approaches church-state issues. However, there is persuasive evidence that among some influential segments of the population, there is a very real antireligious strain.

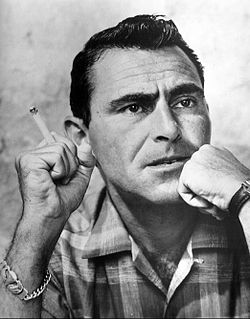

The Chancellor, the late Chancellor, was only partly correct, he was obsolete. But so was the State, the entity he worshipped. Any state, any entity, any ideology that fails to recognize the worth, the dignity, the rights of man, that state is obsolete. A case to be filed under 'M' for mankind... in the Twilight Zone.

Volatility is a symptom that people have no idea of the underlying value-that they have stopped playing the asset game. They're not buying because it's a company with certain attributes. They're buying because the price is rising. People are playing games not related to any concept at all of what the long-term value of the enterprise is. And they know it.