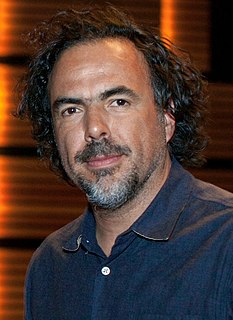

A Quote by Alejandro Gonzalez Inarritu

The corporation and the hedge funds have a hold on Hollywood, and they all want to make money on anything that signifies cinema.

Related Quotes

When I was 23, 24, I started covering hedge funds - a lot of this was luck - when no one else did. This was before hedge funds were the prettiest girl in school: this was pre-nose job and treadmill for hedge funds, when nobody talked to them - back then, it was just all about insurance companies and money managers.

We are seeing more managed money and, to an extent, institutional money entering the space. Anecdotally speaking, I know of many people who are working at hedge funds or other investment managers who are trading cryptocurrency personally, the question is, when do people start doing it with their firms and funds?

I think there are probably too many hedge fund managers in the world, as well as active fund managers. The hedge fund industry is very efficient. We see a lot of hedge funds open and a lot close. It's very binary. You either succeed or fail in the hedge fund world. If you succeed, the amount the managers make it beyond most people's wildest dreams of wealth.

Hedge funds are investment pools that are relatively unconstrained in what they do. They are relatively unregulated (for now), charge very high fees, will not necessarily give you your money back when you want it, and will generally not tell you what they do. They are supposed to make money all the time, and when they fail at this, their investors redeem and go to someone else who has recently been making money. Every three or four years they deliver a one-in-a-hundred year flood. They are generally run for rich people in Geneva, Switzerland, by rich people in Greenwich, Connecticut.