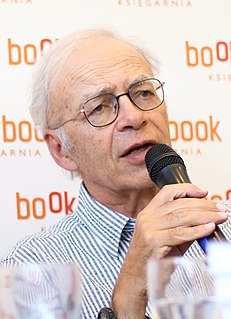

A Quote by Austin Ligon

After careful consideration, we have decided that for our next fiscal year, we'll issue guidance on comparable store used unit sales and on earnings per share only for the full fiscal year. We will no longer issue quarterly guidance. This decision reflects our continuing focus on longer-term store, sales, and earnings growth and on return on invested capital, and our recognition that the performance in shorter-term periods can be more volatile than over the longer term. As we report our quarterly results, we plan to comment on how our performance is tracking against our annual guidance.

Quote Topics

After

Against

Annual

Capital

Careful

Comment

Comparable

Consideration

Continuing

Decided

Decision

Earnings

Fiscal

Fiscal Year

Focus

Full

Growth

Guidance

How

Invested

Issue

Longer

More

Next

Only

Our

Over

Per

Performance

Periods

Plan

Recognition

Reflects

Report

Results

Return

Sales

Share

Store

Term

Than

Tracking

Unit

Used

Volatile

Will

Year

Related Quotes

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.

This is a devastating problem, is, the longer our children are in school, the worse they do. Year after year after year, our children in America are falling further behind. Our 3- and 4-year-olds enter kindergarten OK, and they fall further and further behind. Each year, children in other countries are learning more than children in this country. And so the gap between American student performance in Singapore and Finland and South Korea and Canada and these other countries, the gap widens year after year after year.

The constant drive for campaign dollars has distorted decision-making in Washington, DC, to the point where our systems can no longer effectively address complex, long-term problems like the climate crisis. Which brings me to my other major concern - the short-term focus of capitalism. It distorts the allocation of resources and the decision-making processes of companies.

Anthony and I are putting together a company where we won't lose our jobs based on quarterly earnings and can afford to play a longer game. That short game is what creates a glut of mediocrity in the market because people are desperate for hits, and it puts so much pressure on executives to deliver them. We will take that pressure off the artists.