A Quote by Barbara Corcoran

Especially if you're over 40, shortening the term of your loan to pay it off sooner could make you mortgage-free in retirement.

Related Quotes

After you marry, every asset either of you acquires is jointly held. That's why you both need to be in sync on your long-term financial goals, from paying off the mortgage to putting away for retirement. Ideally, you should talk about all this before you wed. If you don't, you can end up deeply frustrated and financially spent.

I live in a Spanish-style hillside home in Los Angeles, California. I paid $900,000 in 1995. It's perhaps worth about $3m now. Thankfully, I paid off my mortgage before the crash because I could see it coming. I worried that I would be caught having to pay off a very high mortgage for a house I couldn't sell.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

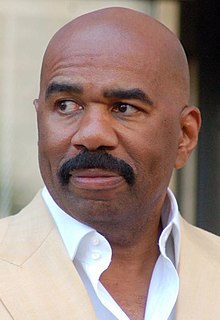

I'm here to tell you, though, ladies that the term "gold digger" is one of the traps we men set to keep you off our money trail; we created that term for you so that we can have all our money and still get everything we want from you without you asking for or expecting this very basic, instincual responsibility that men all over the world are obligated to assume and embrace. ... KNOW THIS: It is your right to expect that a man will pay for your dinner, your movie ticket, your club entry fee, or whatever else he has to pay for in exhange for your time.

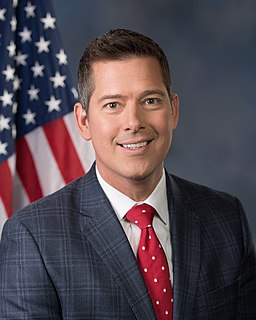

If you wanted to create jobs in a way that has minimal effect on the deficit but has government action, the two best things you could do are the infrastructure bank and a simple SBA-like loan guarantee for all building retrofits, where the contractor or the energy-service company guarantees the savings. So that allows the bank to loan money to let a school or a college or a hospital or a museum or a commercial building unencumbered by debt to loan it on terms that are longer, so you can pay it back only from your utility savings. You could create a million jobs doing that.