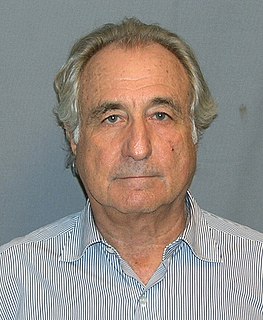

A Quote by Bernard Madoff

Wall Street is one big turf war. By benefiting one person you are disadvantaging another person.

Related Quotes

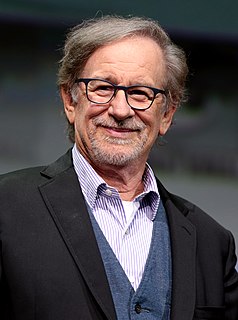

I think the beauty of the film industry is that if another person tries to become another person or act like another person or imitate another person, they don't really get too far. When that person starts to realize who they are and what they can bring to the table, they start to blossom and grow. With that, it's not so much me looking towards my predecessors who have paved the way in the industry - it's more getting inspired. I get little bits and pieces of what I can take from any and everybody.

The two reasons that Bernie Sanders gave her fits was the Iraq War and her association with Wall Street. Wall Street owns Hillary Clinton. Wall Street has bought Hillary Clinton and whatever policy considerations she can give them if she gets elected. They have bought her already. That's what all the speech income is really all about.

This is a lesson about life: This is one person. This is another person. This is one person trying to understand another person, even though it doesn't have room to download the other person into it's brain. It cannot understand the other person, even though it tries to. So he ends up overflowing with knowledge.

Wall Street owns the country. It is no longer a government of the people, for the people and by the people, but a government for Wall Street, by Wall Street, and for Wall Street. The great common people of this country are slaves, and monopoly is the master…Let the bloodhounds of money who have dogged us thus far beware.