A Quote by Brad Bird

You're buying for the benefit of the cottage experience at a fraction of the price.

Related Quotes

I have a way to photograph. You work with space, you have a camera, you have a frame, and then a fraction of a second. It's very instinctive. What you do is a fraction of a second, it's there and it's not there. But in this fraction of a second comes your past, comes your future, comes your relation with people, comes your ideology, comes your hate, comes your love - all together in this fraction of a second, it materializes there.

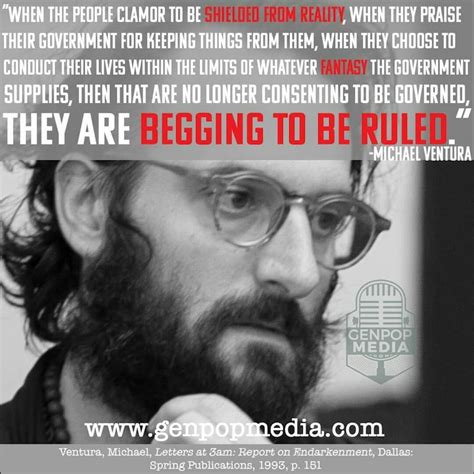

I try to write into the heart of experience. Then, through the experience of the writing, that heart reveals itself to me. To write it down for others, as a door to go through it they choose, is the price of the experience, the price of the ticket. This is the demand that God, if you like, puts on you for being an artist.

Turn right up ahead," he directed. "It'll take us directly to my cottage." She did as he asked. "Does your cottage have a name?" "My Cottage." "I might have known," she muttered. He smirked. Quite a feat, in her opinion, since he looked sick as a dog. "I'm not kidding," he said. Sure enough, in another minute they pulled up in front of an elegant country house, complete with a small, unobtrusive sign in front reading, MY COTTAGE

I buy stocks when they are battered. I am strict with my discipline. I always buy stocks with low price-earnings ratios, low price-to-book value ratios and higher-than-average yield. Academic studies have shown that a strategy of buying out-of-favor stocks with low P/E, price-to-book and price-to-cash flow ratios outperforms the market pretty consistently over long periods of time.

Volatility is a symptom that people have no idea of the underlying value-that they have stopped playing the asset game. They're not buying because it's a company with certain attributes. They're buying because the price is rising. People are playing games not related to any concept at all of what the long-term value of the enterprise is. And they know it.

The idea that when people see prices falling they will stop buying those cheaper goods or cheaper food does not make much sense. And aiming for 2 percent inflation every year means that after a decade prices are more than 25 percent higher and the price level doubles every generation. That is not price stability, yet they call it price stability. I just do not understand central banks wanting a little inflation.