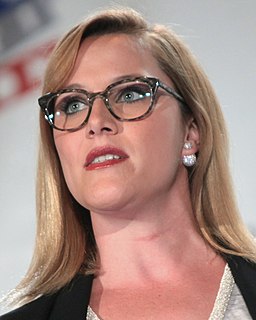

A Quote by Carly Fiorina

The truth is, Hillary Clinton's ideas create more income inequality. Why? Because bigger government creates crony capitalism. When you have a 70,000 page tax code, you've got to be very wealthy, very powerful, very well connected to dig your way through that tax code.

Related Quotes

We [the Republicans] help the middle class when we unburden them from the very policies that Hillary Clinton would double down on. She champions Big Government, which we know enables crony capitalism and exacerbates inequality. If you are wealthy, powerful and well-connected, you can handle Big Government.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

It's one thing to maintain that upper-income earners should pay higher tax rates because they are better able to shoulder the burden for essential government services. But it's constitutional blasphemy to claim that the tax code should be used as a weapon against the wealthy and that the state should be the tyrannical arbiter of how income is distributed.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

You know, people like Hillary Clinton think you grow the economy by growing Washington. I think most of us in America understand that people, not the government creates jobs. And one of the best things we can do is get the government out of the way, put in reign in all the out of control regulations, put in place and all of the above energy policy, give people the education, the skills that the need to succeed, and lower the tax rate and reform the tax code.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

If we had a flat tax code rather than a 70,000-page document full of cronyism and favors, bureaucrats and elected officials wouldn't have the power to do you any favors. That's what we need. You would have to compete on your own on a level playing field, but that's not what the government permits now.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.