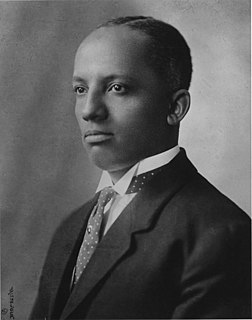

A Quote by Carter G. Woodson

The author takes the position that the consumer pays the tax, and as such every individual of the social order should be given unlimited opportunity to make the most of himself.

Related Quotes

Every attempt, by whatever authority, to fix a maximum of productive labor by a given worker in a given time is an unjust restriction upon his freedom and a limitation of his right to make the most of himself in order that he may rise in the scale of the social and economic order in which he lives. The notion that all human beings born into this world enter at birth into a definite social and economic classification, in which classification they must remain permanently through life, is wholly false and fatal to a progressive civilization.

The IRS spends God knows how much of your tax money on these toll-free information hot lines staffed by IRS employees, whose idea of a dynamite tax tip is that you should print neatly. If you ask them a real tax question, such as how you can cheat, they're useless. So, for guidance, you want to look to big business. Big business never pays a nickel in taxes, according to Ralph Nader, who represents a big consumer organization that never pays a nickel in taxes. . . .

The lack of opportunity is ever the excuse of a weak, vacillating mind. Opportunities! Every life is full of them. Every newspaper article is an opportunity. Every client is an opportunity. Every sermon is an opportunity. Every business transaction is an opportunity, an opportunity to be polite, an opportunity to be manly, an opportunity to be honest, an opportunity to make friends.

God hath given to mankind a common library, His creatures; to every man a proper book, himself being an abridgment of all others. If thou read with understanding, it will make thee a great master of philosophy, and a true servant of the divine Author: if thou but barely read, it will make thee thine own wise man and the Author's fool.

One of the most insidious consequences of the present burden of personal income tax is that it strips many middle class families of financial reserves & seems to lend support to campaigns for socialized medicine, socialized housing, socialized food, socialized every thing. The personal income tax has made the individual vastly more dependent on the State & more avid for state hand-outs. It has shifted the balance in America from an individual-centered to a State-centered economic & social system.

Research has shown that middle-income wage earners would benefit most from a large reduction in corporate tax rates. The corporate tax is not a rich-man's tax. Corporations don't even pay it. They just pass the tax on in terms of lower wages and benefits, higher consumer prices, and less stockholder value.

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.