A Quote by Chanda Kochhar

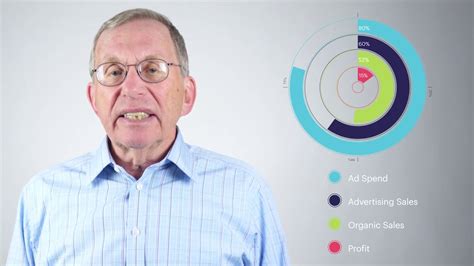

Our large size, capital base, robust funding profile, extensive distribution network, diversified portfolio, presence across the financial services sector, and leadership in technology position us very well to leverage the growth opportunities across the economy.

Related Quotes

When you've got a economy in which 40 percent of economic growth is happening in the financial sector, that turns out that was all an illusion, that it wasn't growth based on real products and services, but just a bunch of paper shuffling and a house of cards, then what's gonna emerge, at some point, is a sense of resentment, a sense that the system's rigged, and it's not working for ordinary people. And it's not fulfilling the basic American dream.