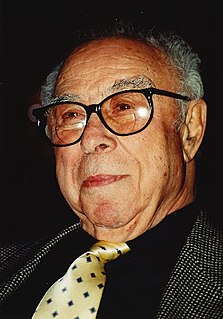

A Quote by Charles Adams

Though tax records are generally looked upon as a nuisance, the day may come when historians will realize that tax records tell the real story behind civilized life. How people were taxed, who was taxed, and what was taxed tell more about a society than anything else. Tax habits could be to civilization what sex habits are to personality. They are basic clues to the way a society behaves.

Related Quotes

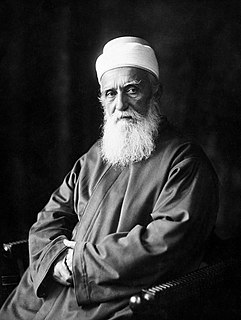

Our ideal society finds it essential to put a rent on land as a way of maximizing the total consumption available to the society. ...Pure land rent is in the nature of a 'surplus' which can be taxed heavily without distorting production incentives or efficiency. A land value tax can be called 'the useful tax on measured land surplus'.

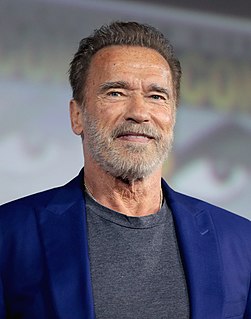

We're bringing the corporate rate down to 20 percent from 35 percent. That's a massive - this will be the biggest tax cut in history. In the history of our country. And that's great. And we need it. Because right now, our country's about the highest taxed or certainly one of the highest taxed in the world. And we can't have that. So we're going to have a country that's toward the lower end.

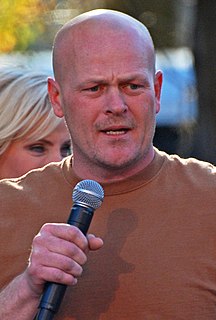

The American people I talk to don't spend every moment thinking, 'How can I tax my neighbor more than they're being taxed?' They say, 'How can I get a good job? How can my kids get good jobs? How can seniors have a confidence in their future when they know that Social Security, Medicare and Medicaid are bankrupt?'