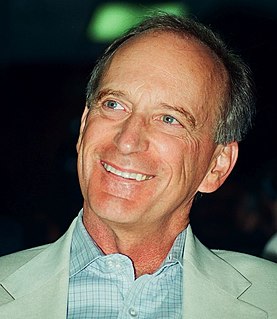

A Quote by Denis Hayes

f the government is going to put money into the automobile sector, it should break up GM and Chrysler as a condition of financial aid, and it should be even-handed in its treatment of start-up firms like Tesla, Miles, Fisker, and others. It would be terrible to kill the entrepreneurs who have taken great risks to bring new automotive technologies to market by pumping tax dollars into the behemoths that have done everything wrong for the last years.

Quote Topics

Aid

Automobile

Break

Break Up

Bring

Chrysler

Condition

Dollars

Done

Entrepreneurs

Even

Everything

Financial

Financial Aid

Going

Government

Great

Great Risk

Handed

Last

Last Year

Like

Market

Miles

Money

New

Others

Pumping

Put

Risks

Sector

Should

Start

Start-Up

Taken

Tax

Tax Dollars

Technologies

Terrible

Tesla

Treatment

Up

Would

Would Be

Wrong

Years

Related Quotes

We are all used to paying a sales tax when we buy things - almost 9 percent here in New York City. The application of this concept to the financial sector could solve our need for revenue, bring some sanity back into the financial sector, and give us a way to raise the revenue we need to run the government in a fiscally responsible way.

Government investment unlocks a huge amount of private sector activity, but the basic research that we put into IT work that led to the Internet and lots of great companies and jobs, the basic work we put into the health care sector, where it's over $30 billion a year in R&D that led the biotech and pharma jobs. And it creates jobs and it creates new technologies that will be productized. But the government has to prime the pump here. The basic ideas, as in those other industries, start with government investment.

If you look for instance at the automobile industry, part of the reason that you have the expansion of that sector, is precisely because we have gone out to talk to the automobile companies to explain government policy with regard to that sector, to talk to them about the MIDP and things like that. And indeed, it has been a very important part of attracting those investors to put in money in the South African economy and build motorcars in South Africa.

When large companies take on risk, then they impose risks on the rest of the system. And these are systemic risks and these systemic risks we never used to think were really that important, but as soon as we recognize how the financial sector - the risks the financial sector takes on can impact the entire global economy, we realize that those risks needed to be controlled for the social good.

That's the problem with the financial sector. Banks and the financial sector live in the short run, not the long run. In principle the government is supposed to make regulations that help the economy over time. But once it's taken over by the financial sector, the government lives in the short run too.

Tax reduction has an almost irresistible appeal to the politician, and it is no doubt also gratifying to the citizen. It means more dollars in his pocket, dollars that he can spend if inflation doesn't consume them first. But dollars in his pocket won't buy him clean streets or an adequate police force or good schools or clean air and water. Handing money back to the private sector in tax cuts and starving the public sector is a formula for producing richer and richer consumers in filthier and filthier communities. If we stick to that formula we shall end up in affluent misery.