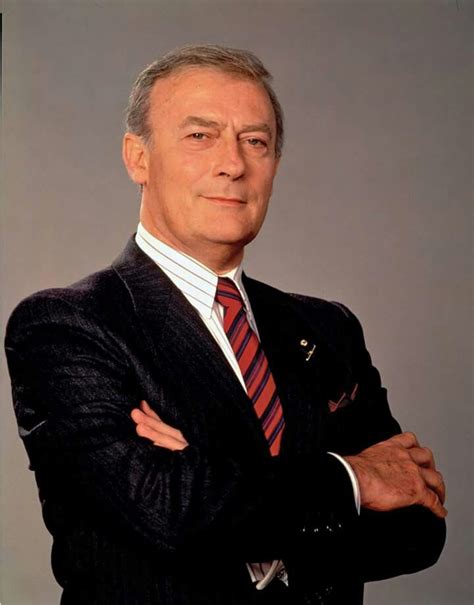

A Quote by Glenn Hubbard

I don't accept as an article of faith that lots of short-term stimulus boosts the economy and gets us back on the long-term trajectory.

Related Quotes

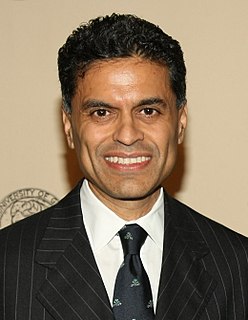

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

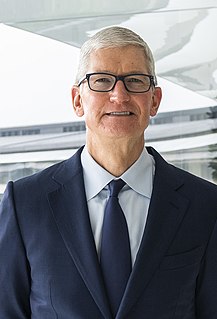

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.