A Quote by Jan Hatzius

Biggest pent-up negative wealth effect you can see in the economic data going back to 1952.

Related Quotes

Nothing is going to stay the same; nothing's gonna sound like in 1952. There's some stuff that has some elements of back in the day, like back in the 90's, back in the 80's or whatever. Some elements, but it's not going to be the same, exactly, sounding. And I love it, I've seen the music change. I've seen the flow and the energy go from turned up to turned down to back to turned up. I like to try different stuff. I don't like to do the same old thing over and over again. I don't like to be repetitive, that gets on my nerves.

Not going back is fine. Not going back but occasionally visiting might be best. Not going back but remembering so you don’t see the same view twice. Not going back so you can turn a new page, write a new chapter, develop an entire new list. Not going back so you can stretch and grow and see yourself in a light that you never knew existed. Not going back so that you can fly. Fly.

We need a dialogue with the Iranians, and it is going to take both carrots and sticks. We employed very tough economic sanctions, and they are having an effect. But we also have to give the Iranians an idea of what the economic and cooperative possibilities would be if they did give up their quest for a nuclear weapon.

Disruptive technology is a theory. It says this will happen and this is why; it's a statement of cause and effect. In our teaching we have so exalted the virtues of data-driven decision making that in many ways we condemn managers only to be able to take action after the data is clear and the game is over. In many ways a good theory is more accurate than data. It allows you to see into the future more clearly.

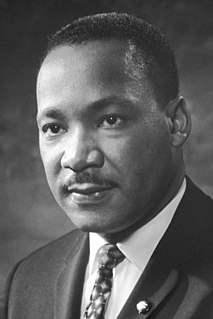

White Americans must be made to understand the basic motives underlying Negro demonstrations. Many pent-up resentments and latent frustrations are boiling inside the Negro, and he must release them. It is not a threat but a fact of history that if an oppressed people's pent-up emotions are not nonviolently released, they will be violently released.