A Quote by Linda Johnson Rice

The bitter might be just an initial reaction of, 'Oh my goodness, it's sold,' but not really understanding fully that I will be chairman emeritus of the new company, which is Ebony Media Operations. It is African-American led and owned, and I have a seat on the board, and I also have an equity position in the company, so I'm still there.

Related Quotes

We have signed an exclusive licensing agreement with a company called TurnerPatterson, another African-American company, and what I thought would be a great vehicle for 'Ebony,' since it is such a strong brand name with tremendous loyalty, is to grow that brand name even more across different areas.

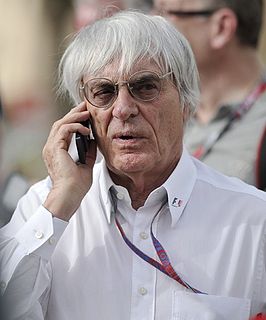

Probably when I gave things to Slavica [ Ecclestone], you know the shares of the company, and things like that. And she put it all in trust and the trust sold the shares. Um, would I turn the clock back if I could and so I still owned the company completely? Probably yes. It probably wasn't a good decision, but it was the decision that had to be made. Was I happy that I made it? No.

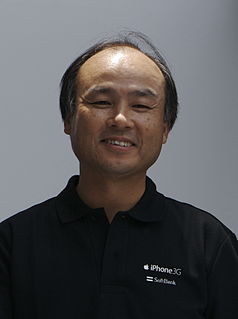

The company [Microsoft] really has to chart a direction in mobile devices. Because if you're going to be mobile-first, cloud-first you really do need to have a sense of what you're doing in mobile devices. I had put the company on a path. The board as I was leaving took the company on a path by buying Nokia, they kind of went ahead with that after I told them I was going to go. The company, between me and the board, had taken that sort of view. Satya, he's certainly changed that. He needs to have a clear path forward. But I'm sure he'll get there.