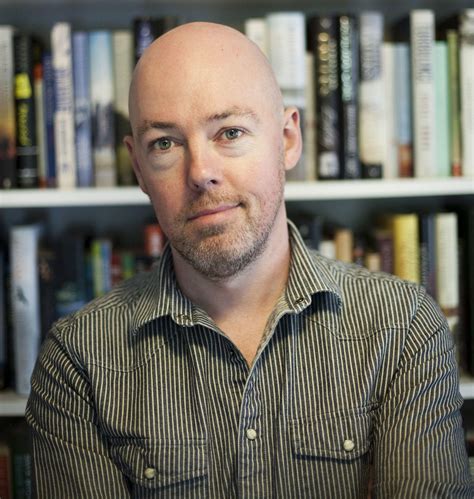

A Quote by Martin Gilbert

I think the asset management industry, especially in the US, is going through a pretty tough time. If you talk to the CEO of a US asset manager, morale would be at a low, even though stock markets are at almost record levels.

Related Quotes

In the 40 years I've been working as an economist and investor, I have never seen such a disconnect between the asset market and the economic reality... Asset markets are in the sky, and the economy of the ordinary people is in the dumps, where their real incomes adjusted for inflation are going down and asset markets are going up.

I think there are probably too many asset management companies in the world, and I think the place to be is either big or small. The area where it is probably more difficult to be is in the middle ground, where you've got that cost of regulation, you've got the cost of buying your own research, you've got all the costs of running an asset management company without the benefits of a big income producing asset.

The problem is that you're creating a system of bubble finance where interest rates are so low that people can speculate. An asset value goes up. You put it up as collateral. You borrow against it. You buy more of the asset. You then take the rising asset. You borrow against it again. This is the nature of what's going on in the world. This isn't an excess of real savings. This is an excess of artificial credit that's being fueled by all the central banks.

My net worth is the market value of holdings less the tax payable upon sale. The liability is just as real as the asset unless the value of the asset declines (ouch), the asset is given away (no comment), or I die with it. The latter course of action would appear to at least border on a Pyrrhic victory.

I think the issue that millennials have is that the return on asset classes such as bonds, cash, are so low now compared to the historical levels that it's very difficult for them to save enough to be able to retire comfortably. If interest rates do trend back upwards, it may be less of a problem going forward.

We live in a very risky world and investors should not get "carried away" with excessive allocations to equities, or for that matter, real estate. As always asset allocation and low cost and broad diversification will be essential in earning one's fair share of whatever returns our financial markets are generous enough to bestow upon us.

Any onset of increased investor caution elevates risk premiums and, as a consequence, lowers asset values and promotes the liquidation of the debt that supported higher asset prices, ... This is the reason that history has not dealt kindly with the aftermath of protracted periods of low risk premiums.