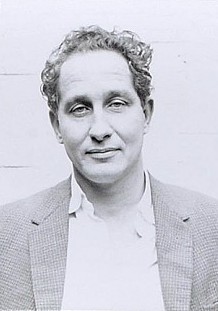

A Quote by Nayib Bukele

We'll invest in infrastructure and productive infrastructure like railroads and ports and bridges and schools, things that will have a return, economic return or social return.

Related Quotes

For countries such as Kenya to emerge as economic powerhouses, they need better infrastructure: roads, ports, smart grids and power plants. Infrastructure is expensive, and takes a long time to build. In the meantime, hackers are building 'grassroots infrastructure,' using the mobile-phone system to build solutions that are ready for market.

Our infrastructure of bridges, roads and ports has been given a D-level rating by many civil engineer societies. The government should shift some money from the Defense budget and hire companies to fix our infrastructure. As for non-construction workers, we need to do job retraining in those growing areas where more skilled workers will be needed.

For an economy built to last we must invest in what will fuel us for generations to come. This is our history - from the Transcontinental Railroad to the Hoover Dam, to the dredging of our ports and building of our most historic bridges - our American ancestors prioritized growth and investment in our nation's infrastructure.

We invest in things like the future, like our children, like education. In other words, we invest in things that we understand we will not see an immediate return of investment but everybody knows it will have a positive impact and you can easily measure it over the course of time. Your why is exactly the same thing.

Buying a share of a good business is better than buying a share of a bad business. One way to do this is to purchase a business that can invest its own money at high rates of return rather than purchasing a business that can only invest at lower ones. In other words, businesses that earn a high return on capital are better than businesses that earn a low return on capital.