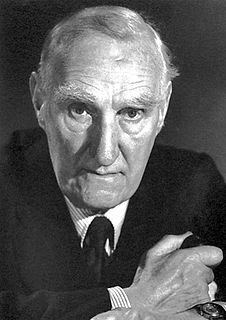

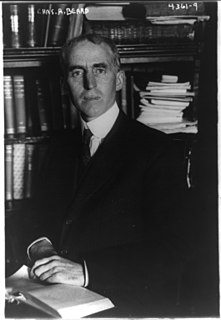

A Quote by Niall Ferguson

In the financial sector, those whom the gods want to destroy they first teach math.

Related Quotes

That's the problem with the financial sector. Banks and the financial sector live in the short run, not the long run. In principle the government is supposed to make regulations that help the economy over time. But once it's taken over by the financial sector, the government lives in the short run too.

When large companies take on risk, then they impose risks on the rest of the system. And these are systemic risks and these systemic risks we never used to think were really that important, but as soon as we recognize how the financial sector - the risks the financial sector takes on can impact the entire global economy, we realize that those risks needed to be controlled for the social good.