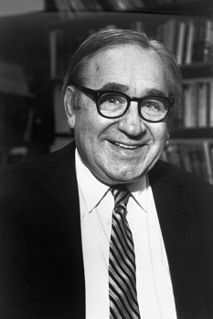

A Quote by Robert Fogel

The president has very little effect on the economy. If you want to put blame or credit, the main person who influences the business cycle is the head of the Federal Reserve Bank.

Related Quotes

The States is run by the Federal Reserve, an institution that answers only to itself and to a few large banks. It's modelled on the Bank of England. Ben Franklin said that one of the main reasons America revolted was to get away from the Bank of England, the mother of all central banks - the most pernicious and insidious of all.

When the secretary of treasury, the head of the central bank, the head of the FDIC (Federal Deposit Insurance Corp.), and the head of the New York Fed say, "We want you to do this because we think it's in the best interest of the United States of America," you know, we're like the Japanese. We're a little patriotic that way. We said, "Yes, sir!"

If the Federal Reserve pursues a policy which Congress or the President believes not to be in the public interest, there is nothing Congress can do to reverse the policy. Nor is there anything the people can do. Such bastions of unaccountable power are undemocratic. The Federal Reserve System must be reformed, so that it is answerable to the elected representatives of the people.