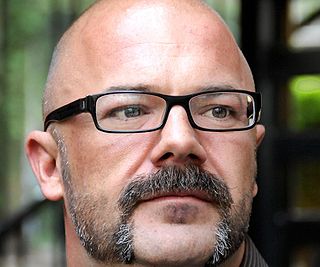

A Quote by Robert Haugen

If we observe the performance of only those funds that remain active, we will tend to find that the average performance of the surviving funds exceeds that of the market.

Related Quotes

Your earning ability is largely determined by the perception of excellence, quality, and value that others have of you and what you do. The market only pays excellent rewards for excellent performance. It pays average rewards for average performance, and it pays below average rewards or unemployment for below average performance.

Index funds have regularly produced rates of return exceeding those of active managers by close to 2 percentage points. Active management as a whole cannot achieve gross returns exceeding the market as a while and therefore they must, on average, underperform the indexes by the amount of these expense and transaction costs disadvantages.

... skepticism about past returns is crucial. The truth is, much as you may wish you could know which funds will be hot, you can't - and neither can the legions of advisers and publications that claim they can. That's why building a portfolio around index funds isn't really settling for average. It's just refusing to believe in magic.

While it is probably a poor idea to own actively managed funds in general, it is truly a terrible idea to own them in taxable accounts... taxes are a drag on performance of up to 4 percentage points each year... many index funds allow your capital gains to grow largely undisturbed until you sell... For the taxable investor, indexing means never having to say you're sorry.

In most cases the favorable price performance will be accompanied by a well-defined improvement in the average earnings, in the dividend, and in the balance-sheet position. Thus in the long run the market test and the ordinary business test of a successful equity commitment tend to be largely identical.