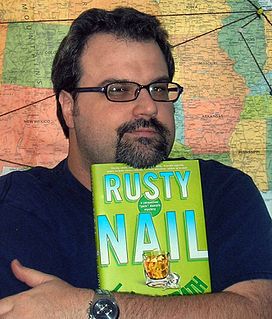

A Quote by Uwe Boll

I produce for a low price and I sell it on my own to 80 countries.

Related Quotes

I buy stocks when they are battered. I am strict with my discipline. I always buy stocks with low price-earnings ratios, low price-to-book value ratios and higher-than-average yield. Academic studies have shown that a strategy of buying out-of-favor stocks with low P/E, price-to-book and price-to-cash flow ratios outperforms the market pretty consistently over long periods of time.

Don't sell yourself short. No one will value you. Set a fair price for you, your book, your services, whatever it is that you have to offer. Most of us set way too low a price. Put it a little higher than you would normally be inclined to do. The worst that can happen is someone will come along and steal it.

Economists may not know much. But we know one thing very well: how to produce surpluses and shortages. Do you want a surplus? Have the government legislate a minimum price that is above the price that would otherwise prevail. That is what we have done at one time or another to produce surpluses of wheat, of sugar, of butter, of many other commodities. Do you want a shortage? Have the government legislate a maximum price that is below the price that would otherwise prevail.