A Quote by Will Durant

Perhaps it is one secret of their power that, having studied the fluctuations of prices, the [bankers] know that history is inflationary.

Related Quotes

Speculation in oil stock companies was another great evil ... From the first, oil men had to contend with wild fluctuations in the price of oil. ... Such fluctuations were the natural element of the speculator, and he came early, buying in quantities and holding in storage tanks for higher prices. If enough oil was held, or if the production fell off, up went the price, only to be knocked down by the throwing of great quantities of stocks on the market.

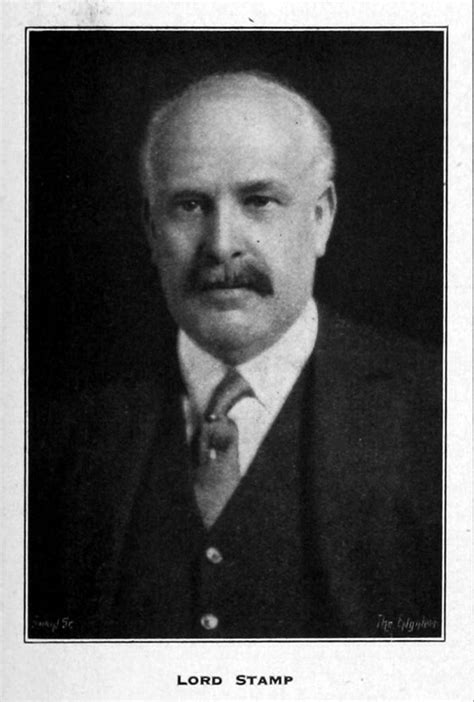

Banking was conceived in iniquity and born in sin... Bankers own the Earth. Take it away from them but leave them the power to create money, and, with the flick of a pen, they will create enough money to buy it back again... Take this great power away from them and all the great fortunes like mine will disappear and they ought to disappear, for then this would be a better and happier world to live in... But, if you want to continue to be a slave of the bankers and pay the cost of your own slavery, then let the bankers continue to create money and control credit.