A Quote by Jared Bernstein

Barack Obama is talking about cutting taxes. On net, he is a tax cutter. But the difference between Obama and John McCain is that Obama is raising some taxes on families, for example, with incomes over $250,000. Now, that amounts to about 2 percent, the richest 2 percent of American households. And even with those tax changes, even with all of the tax changes Obama's talking about, taxes will be lower under Obama than they were under the Clinton years.

Related Quotes

President Lyndon Johnson's administration was known for his War on Poverty. President Obama's will become notable for his War on Prosperity. We're speaking, of course, of Obama's plans to hike income taxes on the most wealthy 2 or 3 percent of the nation. He's not just raising the top rate to 39.6 percent; he's also disallowing about one-third of top earner's deductions, whether for state and local taxes, charitable contributions or mortgage interest. This is an effective hike in their taxes by an average of about 20 percent.

The most pernicious of his [Obama] proposals will be the massive Make Work Pay refundable tax credit. Dressed up as a tax cut, it will be a national welfare program, guaranteeing a majority of American households an annual check to 'refund' taxes they never paid. And it will eliminate the need for about 20% of American households to pay income taxes, lifting the proportion that need not do so to a majority of the voting population.

My tax plan will cut taxes for 95 percent of workers, because we need to put money back into the pockets of struggling middle-class families and close the egregious tax loopholes that have exploded over the last eight years. My plan eliminates capital gains taxes entirely for the small businesses and start-ups that are the backbone of our economy, as opposed to John McCain's plan, which would tax these businesses. John McCain is running to serve out a third Bush term. But the truth is, when it comes to taxes, that's not being fair to George Bush.

In the name of short-term stimulus, he [Obama] will give every American family (who makes less than $200,000) a welfare check of $1,000 euphemistically called a refundable tax credit. And he will so sharply cut taxes on the middle class and the poor that the number of Americans who pay no federal income tax will rise from the current one-third of all households to more than half. In the process, he will create a permanent electoral majority that does not pay taxes, but counts on ever-expanding welfare checks from the government.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

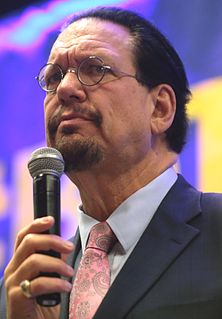

The only difference between Obama and Bush is that Obama is killing more people. He’s about double the numbers now. Can you imagine if McCain had won and did precisely what Obama has done, with every speech and every political maneuver overseas? There’d be riots in the streets about the people we’re killing. And yet because it’s Obama, and he’s better looking and better at reading the teleprompter, we let him get away with it.