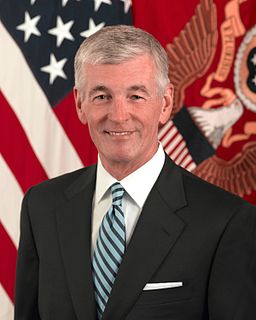

A Quote by Colin Trevorrow

I live in Vermont, and we don't have a tax incentive there, and therefore, we don't have professional crew there.

Related Quotes

Vermont is such a small state, and the most money that's ever been spent in the history of political campaigns there is $2 million. That number is going to be surpassed many times. Vermont remains a "cheap state" for the Republican National Committee. So putting $5 or $10 million into Vermont - compared to New York or California or Illinois - that's small potatoes.

When I became finance minister in 1991, I discovered that the wealth tax rates income - there was taxation on wealth. It was so atrocious and so high that actually nobody could accumulate money in an honest way. I removed that tax, and the result was that Indian companies for the first time acquired an incentive to grow big, to grow rich.

One measure for promoting both stability and fairness across financial market segments is a small sales tax on all financial transactions - what has come to be known as a Robin Hood Tax. This tax would raise the costs of short-term speculative trading and therefore discourage speculation. At the same time, the tax will not discourage "patient" investors who intend to hold their assets for longer time periods, since, unlike the speculators, they will be trading infrequently.