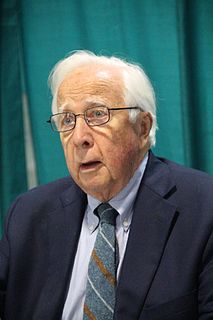

A Quote by Niall Ferguson

When bond prices fall, interest rates soar, with painful consequences for all borrowers.

Quote Topics

Related Quotes

The art of banking is always to balance the risk of a run with the reward of a profit. The tantalizing factor in the equation is that riskier borrowers pay higher interest rates. Ultimate safety - a strongbox full of currency - would avail the banker nothing. Maximum risk - a portfolio of loans to prospective bankrupts at usurious interest rates - would invite disaster. A good banker safely and profitably treads the middle ground.

The key is if the economic data stays soft, maybe we don't have to worry much about interest rates anymore. Then we need to worry about earnings. What gave us a really strong move in stock prices from late May until about two weeks ago was this heightened optimism that maybe interest rates are at that high. That gave you a relief rally. Now reality is setting in - if we've seen the worst on interest rates then we've seen the best on earnings.

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.