Top 53 Deflation Quotes & Sayings

Explore popular Deflation quotes.

Last updated on April 14, 2025.

The Fed is pushing a variety of workarounds that would inject trillions in new money into the economy while bypassing the banking system altogether. Time will tell whether or not this will succeed. Meanwhile, a serious danger lurks around the corner. Once the recession is over, the lending will start again. With fractional-reserve banking and limitless supplies of cash on hand, we will likely see the overall price trends reversed, from deflation to inflation to possible hyperinflation.

The current U.S. and Eurozone depression isn't because of China. It's because of domestic debt deflation. Commodity prices and consumer spending are falling, mainly because consumers have to pay most of their wages to the FIRE sector for rent or mortgage payments, student loans, bank and credit card debt, plus over 15 percent FICA wage withholding for Social Security and Medicare actually, to enable the government to cut taxes on the higher income brackets, as well income and sales taxes.

Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation."

"The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation.

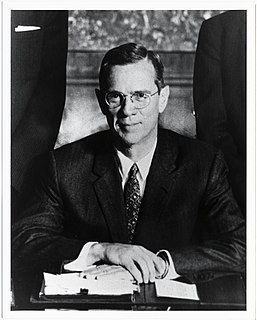

This law represents a cornerstone in a structure which is being built but is by no means completed--a structure intended to lessen the force of possible future depressions, to act as a protection to future administrations of the Government against the necessity of going deeply into debt to furnish relief to the needy--a law to flatten out the peaks and valleys of deflation and of inflation--in other words, a law that will take care of human needs and at the same time provide for the United States an economic structure of vastly greater soundness.

So we are in for years of debt deflation. That means that people have to pay so much debt service for mortgages, credit cards, student loans, bank loans and other obligations

that they have less to spend on goods and services. So markets shrink. New investment and employment fall off, and the economy is falls into a downward spiral.

The basic prescription for preventing deflation is therefore straightforward, at least in principle: Use monetary and fiscal policy as needed to support aggregate spending, in a manner as nearly consistent as possible with full utilization of economic resources and low and stable inflation. In other words, the best way to get out of trouble is not to get into it in the first place.

The U. S. is headed toward a period of business depression... beginning within the next two years, which may exceed that which preceded the War. ... The only thing that will save us is a new gold policy or the discovery of a new process or additional gold fields. If the fall [of gold production] is not prevented by design or accident we shall throttle business, wringing out all profits and experiencing all the evils of deflation.

With QE3, we are essentially being bought out with our own money...and unemployment is being used to facilitate this process in a very clever manner. Monetary inflation is currently being offset by labor deflation. The way you avoid collapse is by printing money and stealing assets. The way you avoid inflation is with labor deflation.

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.

I've learned about the inflation range situation. Obviously with our footballs being inflated to the 12.5-pound range, any deflation would then take us under that specification limit. Knowing that now, in the future we will certainly inflate the footballs above that low level to account for any possible change during the game.

People think of a business cycle, which is a boom followed by a recession and then automatic stabilizers revive the economy. But this time we can't revive. The reason is that every recovery since 1945 has begun with a higher, and higher level of debt. The debt is so high now, that since 2008 we've been in what I call, debt deflation.