Top 1200 Lower Taxes Quotes & Sayings - Page 2

Explore popular Lower Taxes quotes.

Last updated on December 4, 2024.

Up until 1986, the top marginal rate, the top statutory rate was 50 percent. Now it's 35 percent. And all the pressure is on to lower that even further. And this just doesn't make a great deal of sense. When people say, 'Oh, we can't raise taxes on the rich. They'll go on strike, they'll move to another country.' But within recent memory, it hasn't been that long ago that we had rates that were substantially higher. And these people did just fine. I just think that there's a disconnect between the facts of what taxes do and the sort of mythology of what they do.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

By the way on economics, South Carolina is an example to the country of what we should be doing as Americans. This country has a vast manufacturing base. It is growing in manufacturing where America is shrinking and it's because they have reduced taxes and lower regulatory burdens and been pro-business.

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.

Suggestion of the Communist Manifesto was 'abolition of all right of inheritance.' Looking backward upon the past history of estate taxes, we have to realize that they more and more have approached the goal set by Marx. Estate taxes of the height they have already attained for the upper brackets are no longer to be qualified as taxes. They are measures of expropriation.

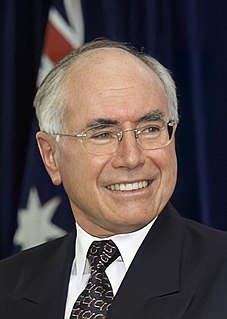

I have had the view that cutting wages is not the path to prosperity, and one of the great myths propagated about my attitude to industrial relations is that I believe in lower wages. I've never believed in lower wages. Never. Never believed in lower wages, I've never believed in lower wages as an economic instrument.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.