Top 1200 Property Taxes Quotes & Sayings

Explore popular Property Taxes quotes.

Last updated on December 18, 2024.

[D]ecade after decade, through taxes and regulations, governments at all levels took ever-increasing control over people's lives, wealth, and property. The control grew exponentially, decade after decade. The rationale was that the control was necessary -- for society, for the poor, for the nation, even for freedom itself. Americans continued living their life of the lie: they continued believing that the more control government exercised over their lives and property, the freer they became.

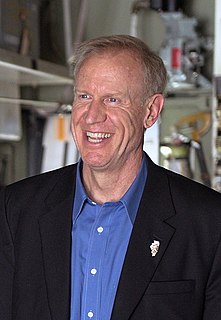

We are angry about paying the highest income taxes and property taxes in the nation and getting less and less for it. We are angry about our incompetent, dysfunctional government that pays no attention to the desires of the people. We are angry about the cesspool of corruption and conflicts of interests and self-dealing that is Albany.

If all those magnificent cathedrals with their valuable lands in Boston, Philadelphia and New York were taxed as they should be, the taxes of women who hold property would be proportionately lightened....I cannot see any good reason why wealthy churches and a certain amount of property of the clergy should be exempt from taxation, while every poor widow in the land, struggling to feed, clothe, and educate a family of children, must be taxed on the narrow lot and humble home.

Taxes, well laid and well spent, insure domestic tranquility, provide for the common defense, and promote the general welfare. Taxes protect property and the environment; taxes make business possible. Taxes pay for roads and schools and bridges and police and teachers. Taxes pay for doctors and nursing homes and medicine.

As property, honestly obtained, is best secured by an equality of rights, so ill-gotten property depends for protection on a monopoly of rights. He who has robbed another of his property, will next endeavor to disarm him of his rights, to secure that property; for when the robber becomes the legislator he believes himself secure.

We have landowners, small growers. We have people who are holding onto land that was acquired by their families after slavery. They need to produce some of the food we eat, so they can pay the taxes and hold onto the property. Taxes keep going up. We, and by we I mean black people, are rapidly becoming a landless people. Our ancestors, coming out of slavery, acquired more than 15 million acres of land. Today, we're probably down to less than 2 million acres.

The churches rose to power on the income from tax-free property. What earthly -or heavenly- right have they got to enjoy a privilege denied to everyone else, even including nonprofit organizations? None! My contention is that with the churches exempted from property taxation, you and I have to pay that much more in taxes to make up for what they're not contributing.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

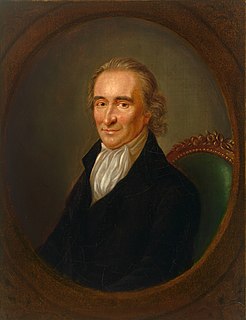

Let these truths be indelibly impressed on our minds — that we cannot be happy, without being FREE — that we cannot be free, without being secure in our property— that we cannot be secure in our property, if, without our consent, others may, as by right, take it away — that taxes imposed on us by parliament, do thus take it away.

Income and inheritance taxes imply the denial of private property, and in that are different in principle from all other taxes. The government says to the citizen: “Your earnings are not exclusively your own; we have a claim on them, and our claim precedes yours; we will allow you to keep some of it, because we recognize your need, not your right; but whatever we grant you for yourself is for us to decide.

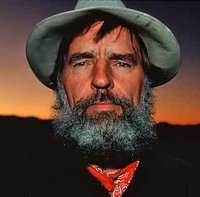

Land taxes is the thing. They got so high that there is no chance to make anything. Not only land but all property tax. You see in the old days, why the only thing they knew how to tax was land, or a house. Well, that condition went along for quite awhile, so even today the whole country tries to run its revenue on taxes on land. They never ask if the land makes anything. "It's land ain't it? Well tax it then."

In the latter sense, a man has a property in his opinions and the free communication of them. He has a property of peculiar value in his religious opinions, and in the profession and practice dictated by them. He has an equal property in the free use of his faculties and free choice of the objects on which to employ them. In a word, as a man is said to have a right to his property, he may be equally said to have a property in his rights.

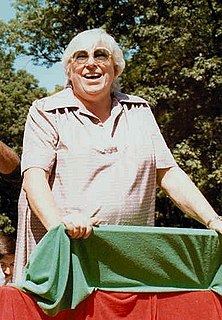

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

But if we are to retain freedom, then we can only do so by keeping the determining mass of the citizens the possessors of property with personal control over it, as individuals or as families. For property is the necessary condition of economic freedom in the full sense of that term. He that has not property is under economic servitude to him who has property, whether the possessor of it be another individual or the State.

The left does understand how raising taxes reduces economic activity. How about their desire for increasing cigarette taxes, soda taxes? What are they trying to do? Get you to buy less. They know. They know that higher taxes reduce activity. It's real simple: If you want more of an activity, lower taxes on it. If you want less of an activity, raise taxes. So if you want more jobs? It's very simple. You lower payroll taxes. If you don't want as many jobs, then you raise corporate taxes. It's that simple, folks.

For the mass of men the idea of artistic creation can only be expressed by an idea unpopular in present discussions - the idea of property... Property is merely the art of the democracy... One would think, to hear people talk, that the Rothschilds and the Rockefellers were on the side of property. But obviously they are the enemies of property; because they are enemies of their own limitations.

As to the Income Tax, my opinion is that the needful revenue would be fairly and most fairly raised if paid by property, and by individuals in proportion to their property. A Property Tax should be an assessment upon all land and buildings, and canals and railroads, but not on property such as machinery, stock in trade, etc. The aristocracy have squeezed all they can out of the mass of the consumers, and now they lay their daring hands on those not wholly impoverished.

Property must be secured or liberty cannot exist. But if unlimited or unbalanced power of disposing property, be put into the hands of those who have no property, France will find, as we have found, the lamb committed to the custody of the world. In such a case, all the pathetic exhortations and addresses of the national assembly to the people, to respect property, will be regarded no more than the warbles of the songsters of the forest.

Legislators cannot invent too many devices for subdividing property... Another means of silently lessening the inequality of property is to exempt all from taxation below a certain point, and to tax the higher portions of property in geometrical progression as they rise. Whenever there is in any country, uncultivated lands and unemployed poor, it is clear that the laws of property have been so far extended as to violate natural right.

One ideological claim is that private property is theft, that the natural product of the existence of property is evil, and that private ownership therefore should not exist... What those who feel this way don't realize is that property is a notion that has to do with control - that property is a system for the disposal of power. The absence of property almost always means the concentration of power in the state.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

It was an easy thing to tax for a young country. And then gradually we moved to property taxes, manufacturing taxes, and the income tax was the answer to a populist demand: Let's go after the rich guys. We got into World War I, and they raised the rates and started taxing the rich. Then we got into World War II, and that's when they taxed everybody, because they just needed more revenue.