Top 1200 Tax Rates Quotes & Sayings - Page 19

Explore popular Tax Rates quotes.

Last updated on December 18, 2024.

This king [Sesostris] divided the land among all Egyptians so as to give each one a quadrangle of equal size and to draw from each his revenues, by imposing a tax to be levied yearly. But everyone from whose part the river tore anything away, had to go to him to notify what had happened; he then sent overseers who had to measure out how much the land had become smaller, in order that the owner might pay on what was left, in proportion to the entire tax imposed. In this way, it appears to me, geometry originated, which passed thence to Hellas.

One of the most insidious consequences of the present burden of personal income tax is that it strips many middle class families of financial reserves & seems to lend support to campaigns for socialized medicine, socialized housing, socialized food, socialized every thing. The personal income tax has made the individual vastly more dependent on the State & more avid for state hand-outs. It has shifted the balance in America from an individual-centered to a State-centered economic & social system.

Both ground- rents and the ordinary rent of land are a species of revenue which the owner, in many cases, enjoys without any care or attention of his own. The annual produce of the land and labour of the society, the real wealth and revenue of the great body of the people, might be the same after such a tax as before. Ground-rents, and the ordinary rent of land are, therefore, perhaps the species of revenue which can best bear to have a peculiar tax imposed upon them.

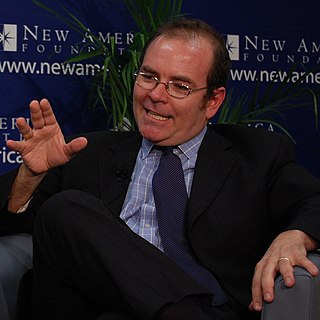

In the name of short-term stimulus, he [Obama] will give every American family (who makes less than $200,000) a welfare check of $1,000 euphemistically called a refundable tax credit. And he will so sharply cut taxes on the middle class and the poor that the number of Americans who pay no federal income tax will rise from the current one-third of all households to more than half. In the process, he will create a permanent electoral majority that does not pay taxes, but counts on ever-expanding welfare checks from the government.