Top 1200 Tax Quotes & Sayings - Page 12

Explore popular Tax quotes.

Last updated on December 12, 2024.

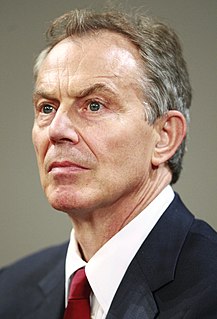

Here's the truth. The proposed top rate of income tax is not 50 per cent. It is 50 per cent plus 1.5 per cent national insurance paid by employees plus 13.3 per cent paid by employers. That's not 50 per cent. Two years from now, Britain will have the highest tax rate on earned income of any developed country.

I love to tell how I'm suffering because one percent we're paying 25 percent of the total. We're not paying 25 percent of the total taxes on individuals. We're paying maybe 25 percent of the income tax, but the payroll tax is over a third of the receipts of the federal government. And they don't take that from me on capital gains. They don't take that from me on dividends. They take from the woman who comes in and takes the wastebaskets out.

Let me have my tax money go for my protection and not for my prosecution. Let my tax money go for the protection of me. Protect my home, protect my streets, protect my car, protect my life, protect my property...worry about becoming a human being and not about how you can prevent others from enjoying their lives because of your own inability to adjust to life.

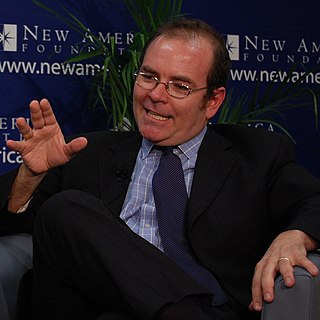

The reality is the most important thing that can be done are these permanent changes like to the tax code, reduction of government spending. These are the things that pop up in economy and move it in the right direction, start to make it an economy that is moving because of the money in the private economy. When you think about it, when the Fed is lowering an interest rate, what it's doing is it's creating more liquidity. It's putting more money into the economy. The same thing happens when you reduce the tax except if happens from physical policy.

As for loving woman, I have never understood why some people had a fit. I still don't. It seems fine to me. If an individual is productive responsible, and energetic, why should her choice in a partner make such a fuss? The government is only too happy to take my tax money and yet they uphold legislation that keeps me a second class citizen. Surely, there should be a tax break for those of us who are robbed of full and equal participation and protection in the life of our nation.

I'd like to help struggling homeowners who can't pay their mortgages, I'd like to invest in our crumbling infrastructure, I'd like to reform the tax system so multimillionaires can't pretend their earnings are capital gains and pay at the rate of 15 percent. I'd like to make public higher education free, and pay for it with a small transfer tax on all financial transactions. I'd like to do much more - a new new deal for Americans. But Republicans are blocking me at every point.

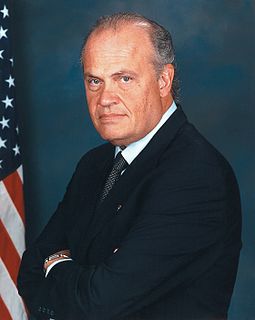

Fewer and fewer people are paying larger and larger percentage of the tax burden, as you know, almost half the people pay no income taxes at all. We're going to have more people in the wagon than we got pulling the wagon before long and that's not going to work. Those jobless numbers, you know, go hand-in-hand with those tax numbers.

President Trump repeatedly says that "America is the highest-taxed country in the world." This is an alternative fact. We pay less in taxes, and our government spends less, as a share of our total wealth, than our counterparts in Western Europe and East Asia. But Trump is right when it comes to corporate tax rates; the U.S. corporate income tax right is among the highest in the world.

His presidency ended more than a decade ago, but politicians, Democrat and Republican, still talk about Ronald Reagan. Al Gore has an ad noting that in Congress he opposed the Reagan budget cuts. He says that because Bill Bradley was one of 36 Democratic Senators who voted for the cuts. Gore doesn’t point out that Bradley also voted against the popular Reagan tax cuts and that it was the tax cuts that piled up those enormous deficits, a snowballing national debt.

Our true choice is not between tax reduction on the one hand and the avoidance of large federal deficits on the other. It is increasingly clear that no matter what party is in power, so long as our national security needs keep rising, an economy hampered by restrictive tax rates will never produce enough revenues to balance our budget, just as it will never produce enough jobs or enough profits.

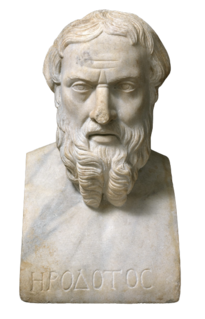

This king [Sesostris] divided the land among all Egyptians so as to give each one a quadrangle of equal size and to draw from each his revenues, by imposing a tax to be levied yearly. But everyone from whose part the river tore anything away, had to go to him to notify what had happened; he then sent overseers who had to measure out how much the land had become smaller, in order that the owner might pay on what was left, in proportion to the entire tax imposed. In this way, it appears to me, geometry originated, which passed thence to Hellas.

The total dividend income declared in 1995 by the bottom 9.7 million Canadian tax-filers (47% of all those submitting tax returns) was $310 million. The estimated dividend income received by the Thomson family in 1995 from its 72% ownership share of the Thomson Corporation and its 22% ownership share of the Hudson's Bay Company was $310 million.

In the name of short-term stimulus, he [Obama] will give every American family (who makes less than $200,000) a welfare check of $1,000 euphemistically called a refundable tax credit. And he will so sharply cut taxes on the middle class and the poor that the number of Americans who pay no federal income tax will rise from the current one-third of all households to more than half. In the process, he will create a permanent electoral majority that does not pay taxes, but counts on ever-expanding welfare checks from the government.

...in terms of business mistakes that I've seen over a long lifetime, I would say that trying to minimize taxes too much is one of the great standard causes of really dumb mistakes. I see terrible mistakes from people being overly motivated by tax considerations. Warren and I personally don't drill oil wells. We pay our taxes. And we've done pretty well, so far. Anytime somebody offers you a tax shelter from here on in life, my advice would be don't buy it.

The best thing we can do for family values is to repeal the income tax. Then families will have the resources they need to implement their own values - and not those of the politicians. With the income tax gone, families will no longer be forced to have two breadwinners by necessity. Children will be raised better, family values will predominate, and crime will diminish. If your local school indoctrinates your child with values that are alien to you, you'll have the money to buy a private education.

Index funds are... tax friendly, allowing investors to defer the realization of capital gains or avoid them completely if the shares are later bequeathed. To the extent that the long-run uptrend in stock prices continues, switching from security to security involves realizing capital gains that are subject to tax. Taxes are a crucially important financial consideration because the earlier realization of capital gains will substantially reduce net returns.

Arthur Laffer's idea, that lowering taxes could increase revenues, was logically correct. If tax rates are high enough, then people will go to such lengths to avoid them that cutting taxes can increase revenues. What he was wrong about was in thinking that income tax rates were already so high in the 1970s that cutting them would raise revenues.

[The taxing power of the state] divides the community into two great classes: one consisting of those who, in reality, pay the taxes and, of course, bear exclusively the burden of supporting the government; and the other, of those who are the recipients of their proceeds through disbursements,and who are, in fact, supported by the government; or, in fewer words, to divide it into tax-payers and tax-consumers. But the effect of this is to place them in antagonistic relations in reference to the fiscal action of the government and the entire course of policy therewith connected.

5: Social security will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1944: The G.I. Bill will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1965: Medicare will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1994: Health care will break small business, become a huge tax burden on our citizens, and bankrupt our country!

Of course, the truth is that the congresspersons are too busy raising campaign money to read the laws they pass. The laws are written by staff tax nerds who can put pretty much any wording they want in there. I bet that if you actually read the entire vastness of the US tax code, you'd find at least one sex scene. ("Yes, yes, YES!" moaned Vanessa as Lance, his taut body moist with moisture, again and again depreciated her adjusted gross rate of annualized fiscal debenture...)

You know, people like Hillary Clinton think you grow the economy by growing Washington. I think most of us in America understand that people, not the government creates jobs. And one of the best things we can do is get the government out of the way, put in reign in all the out of control regulations, put in place and all of the above energy policy, give people the education, the skills that the need to succeed, and lower the tax rate and reform the tax code.

I hope people understand that when you tax corporations that the concrete and the steel and the plastic don't pay. People pay. And so when you tax corporations, either the employees are going to pay or the shareholders are going to pay or the customers are going to pay. And so corporations are people.

What really gets me is this - it's very ironic that those who are most critical of extra tax are those who are most vociferous in demanding extra expenditure. What gets me even more is that having demanded that extra expenditure they are not prepared to face the consequences of their own action and stand by the necessity to get the tax to pay for it. I wish some of them had a bit more guts and courage than they have.

You, as a wage earner have to pay your taxes every year on your income for that year. So if you have a one-time windfall that makes you a lot money you could end up in the top tax bracket. But if you're a corporation you are allowed to reach forward with deferrals for years. Over a 45 to 50 year period, you can balance out the winning years and the losing years in such a way that you pay very little tax, especially considering the time-value of the money.

There's a separation of church and state. If you want the perks that churches have traditionally received, then abide by the rules. If you're going to be involved in the political process, even in soft ways, then surrender the privileges. Let ministers pay income tax on all of their income. Let churches pay income tax, let them pay property taxes. They can't have it both ways. You can't pat the politicians on the back, break the rules, and then get all these perks.

Now, because he knows that his economic theories don't work, he's been spending these last few days calling me every name in the book. Lately he's called me a socialist for wanting to roll-back the Bush tax cuts for the wealthiest Americans so we can finally give tax relief to the middle class. I don't know what's next. By the end of the week he'll be accusing me of being a secret communist because I shared my toys in kindergarten. I shared my peanut butter and jelly sandwich.

Mitt Romney was treated very unfairly. Mitt Romney didn't want to give his tax returns, because people don't understand returns that are complicated, and complex. And he didn't give it. He fought it, fought it, fought it, all the way into September. A month before the election, he gave his tax returns. And they picked out two items that were absolutely perfect. He did nothing wrong. And his returns are very much smaller than my returns.

Let's talk about how to fill out your 1984 tax return. Here's an often overlooked accounting technique that can save you thousands of dollars: For several days before you put it in the mail, carry your tax return around under your armpit. No IRS agent is going to want to spend hours poring over a sweat-stained document. So even if you owe money, you can put in for an enormous refund and the agent will probably give it to you, just to avoid an audit. What does he care? It's not his money.

One of the most insidious consequences of the present burden of personal income tax is that it strips many middle class families of financial reserves & seems to lend support to campaigns for socialized medicine, socialized housing, socialized food, socialized every thing. The personal income tax has made the individual vastly more dependent on the State & more avid for state hand-outs. It has shifted the balance in America from an individual-centered to a State-centered economic & social system.

If Congress sees fit to impose a capitation, or other direct tax, it must be laid in proportion to the census; if Congress determines to impose duties, imposts, and excises, they must be uniform throughout the United States. These are not strictly limitations of power. They are rules prescribing the mode in which it shall be exercised... This review shows that personal property, contracts, occupations, and the like have never been regarded by Congress as proper subjects of direct tax.

We're going to bring a lot of money in on trade. We're going to bring a lot of money on reciprocal. You know, as an example, when you have countries with a big tax and we get nothing for the same product and we're paying - our companies are paying 100 percent tax in some countries and if they send their product to us we pay nothing. Doesn't make sense.

We need a common European tax policy that closes these tax loopholes. We need a common European social policy that prevents social dumping. We need an effective securing of our external borders and a smart way of fighting terrorism. Acting as a state within a national framework is no longer enough. The German chancellor has completely failed to convey that throughout her years in power. We need a re-start for Europe.

The history of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business and invest it in tax-exempt securities or to find other lawful methods of avoiding the realization of taxable income. The result is that the sources of taxation are drying up; wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people.

If you're a wealthy heir with a trust fund, and you sell stocks, make your 10% gains since Donald Trump, and then you buy other stocks, you can avoid paying taxes. And if your accountant registers your wealth offshore in a Panamanian fund, like Russian kleptocrats do - and as more and more Americans do - you don't have to pay any tax at all, because it's not American income, it's foreign income in an enclave without an income tax.

Both ground- rents and the ordinary rent of land are a species of revenue which the owner, in many cases, enjoys without any care or attention of his own. The annual produce of the land and labour of the society, the real wealth and revenue of the great body of the people, might be the same after such a tax as before. Ground-rents, and the ordinary rent of land are, therefore, perhaps the species of revenue which can best bear to have a peculiar tax imposed upon them.

The Democrats are going to tax everybody through the roof. It is going to be focused on people that are wealthy because that's who they can tax. When you look at the stimulus plan - see, this doesn't make any sense, this is not working, it's not going to work, it's not intended to work the way we all were told it was gonna work. Health care is not going to get better. It's gonna get worse. It's gonna get rationed. The economy, the energy sector, nothing is being improved here. Everything's being wrecked.

The most pernicious of his [Obama] proposals will be the massive Make Work Pay refundable tax credit. Dressed up as a tax cut, it will be a national welfare program, guaranteeing a majority of American households an annual check to 'refund' taxes they never paid. And it will eliminate the need for about 20% of American households to pay income taxes, lifting the proportion that need not do so to a majority of the voting population.

The Government in their own terms, for example, they banked the income for the backpackers' tax. But they had a process attached to the backpackers' tax of review that they wanted to go through. What the Government's saying now with this bill is any process, any detail, any reinvestment that Labor had as part of its package, we're meant to ignore all of that and it's only the cut part of it that we're meant to be committed to.

Donald Trump is a businessman, not a career politician. He actually built a business. Those tax returns that were - that came out publicly this week show that he faced some pretty tough times 20 years ago. But like virtually every other business, including the New York Times not too long ago, he used what's called net operating loss. We have a tax code that actually is designed to encourage entrepreneurship in this country.

Some of the worst abuses of government force in recent years were precipitated by technical and victimless gun-law violations. For example, the BATF claimed that the Branch Davidians possessed machine guns without paying the required federal tax and filling in the proper registration forms. So a tax case worth less than $10,000 led to a 76-man helicopter, machine gun, and grenade assault on a home in which 2/3 of the occupants were women and children.