Top 1200 Taxes Quotes & Sayings

Explore popular Taxes quotes.

Last updated on November 21, 2024.

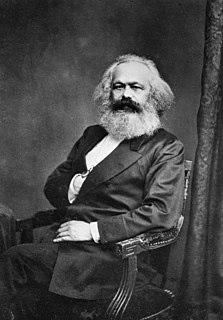

Suggestion of the Communist Manifesto was 'abolition of all right of inheritance.' Looking backward upon the past history of estate taxes, we have to realize that they more and more have approached the goal set by Marx. Estate taxes of the height they have already attained for the upper brackets are no longer to be qualified as taxes. They are measures of expropriation.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

The left does understand how raising taxes reduces economic activity. How about their desire for increasing cigarette taxes, soda taxes? What are they trying to do? Get you to buy less. They know. They know that higher taxes reduce activity. It's real simple: If you want more of an activity, lower taxes on it. If you want less of an activity, raise taxes. So if you want more jobs? It's very simple. You lower payroll taxes. If you don't want as many jobs, then you raise corporate taxes. It's that simple, folks.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

To lay taxes to provide for the general welfare of the United States, that is to say, 'to lay taxes for the purpose of providing for the general welfare.' For the laying of taxes is the power, and the general welfare the purpose for which the power is to be exercised. They are not to lay taxes ad libitum for any purpose they please; but only to pay the debts or provide for the welfare of the Union.

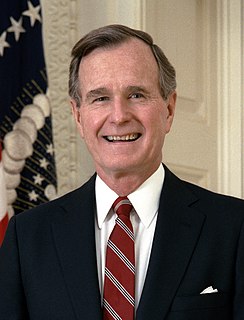

I'm the one who will not raise taxes. My opponent now says he'll raise them as a last resort, or a third resort. But when a politician talks like that, you know that's one resort he'll be checking into. My opponent, my opponent won't rule out raising taxes. But I will. And The Congress will push me to raise taxes and I'll say no. And they'll push, and I'll say no, and they'll push again, and I'll say, to them, Read my lips: no new taxes.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

Taxes, well laid and well spent, insure domestic tranquility, provide for the common defense, and promote the general welfare. Taxes protect property and the environment; taxes make business possible. Taxes pay for roads and schools and bridges and police and teachers. Taxes pay for doctors and nursing homes and medicine.

When a party can't think of anything else they always fall back on Lower Taxes. It has a magic sound to a voter, just like Fairyland is spoken of and dreamed of by all children. But no child has ever seen it; neither has any voter ever lived to see the day when his taxes were lowered. Presidents have been promising lower taxes since Washington crossed the Delaware by hand in a row boat. But our taxes have gotten bigger and their boats have gotten larger until now the President crosses the Delaware in his private yacht.

You could not possibly maintain the current level of government taxation without the taxes being hidden, and they are hidden in two very different ways. They are hidden through withholding, but they are also hidden by being imposed on business, supposedly on business, when really, of course, business can't pay taxes, only people can pay taxes.

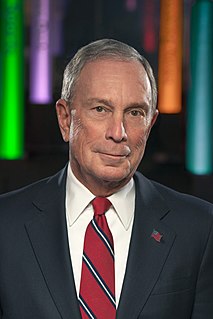

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.